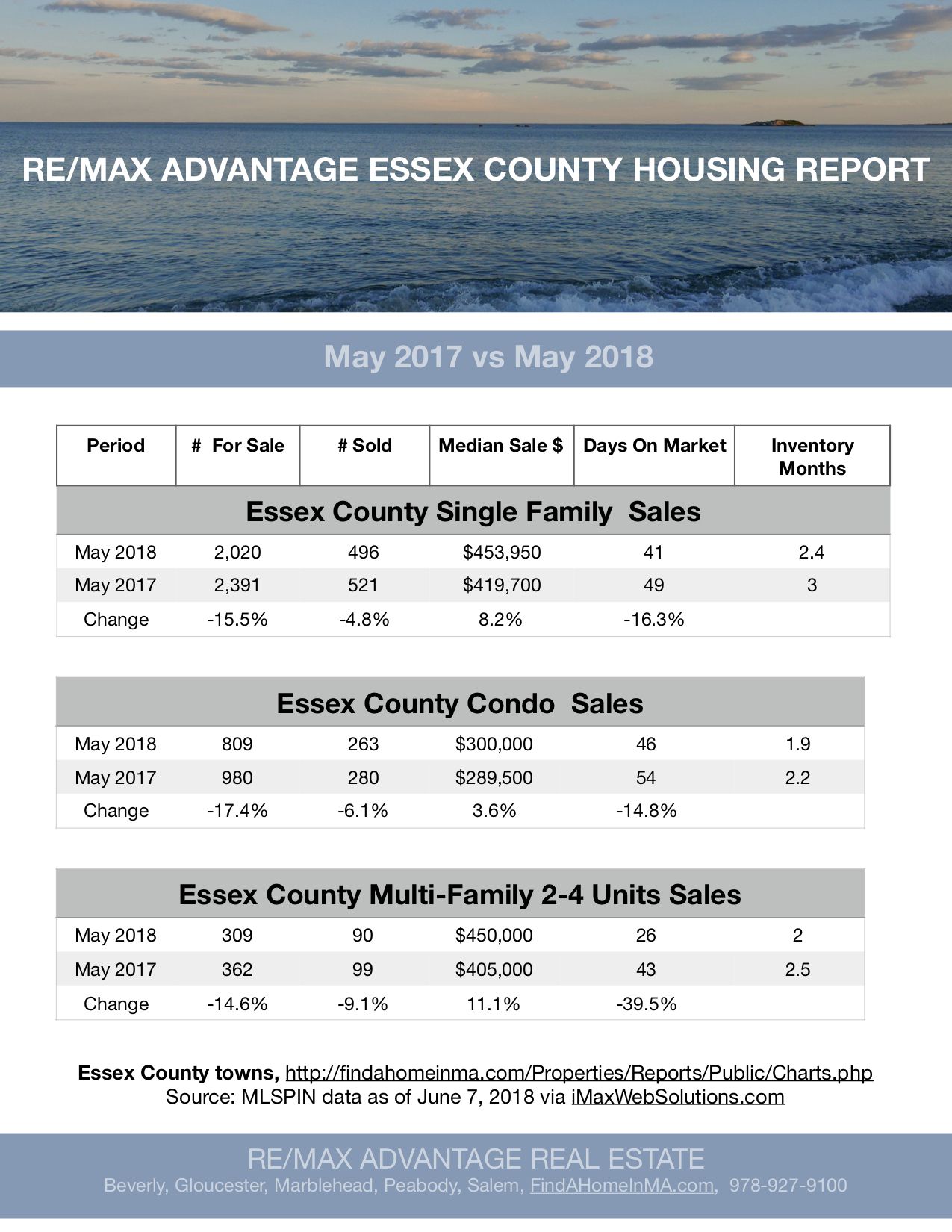

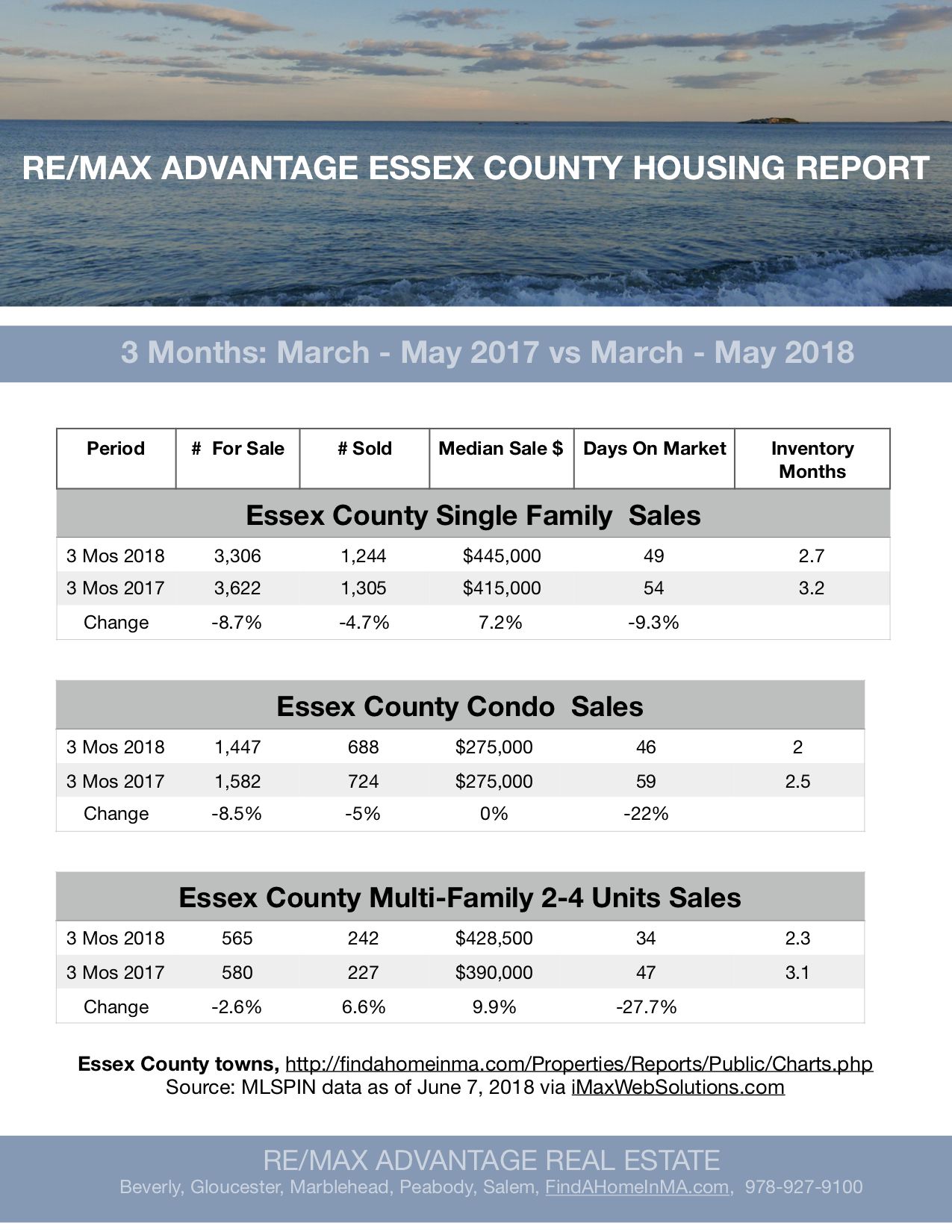

Essex County Housing Reports: May 2017 vs 2018 and March - May 2017 vs March - May 2018

Inventory down and sales prices up. - breakdown by property type:

Single Family: May: Inventory Down 15.5% and Sale Prices Up 8.2%: 3 Months Inventory Down 8.7% and Sale Prices Up 7.2%

Condo: May Inventory Down 17.4% and Sale Prices Up 3.6%: 3 Months Inventory Down 8.5% and Sale Prices Unchanged 0%

Muilti-Family: May Inventory Down 14.6% and Sale Prices Up 11.1%: 3 Months Inventory Down 2.6% and Sale Prices Up 9.9%

To view data for every Essex County town, go to: http://www.sullivanteam.com/Properties/Reports/Public/Charts.php

To dowload the full Housing Report go to: http://sullivanteam.com/pages/EssexCountyHousingReports