https://bit.ly/2yEaakK

Despite a Dip in March, Home Sales Push Ahead

Share

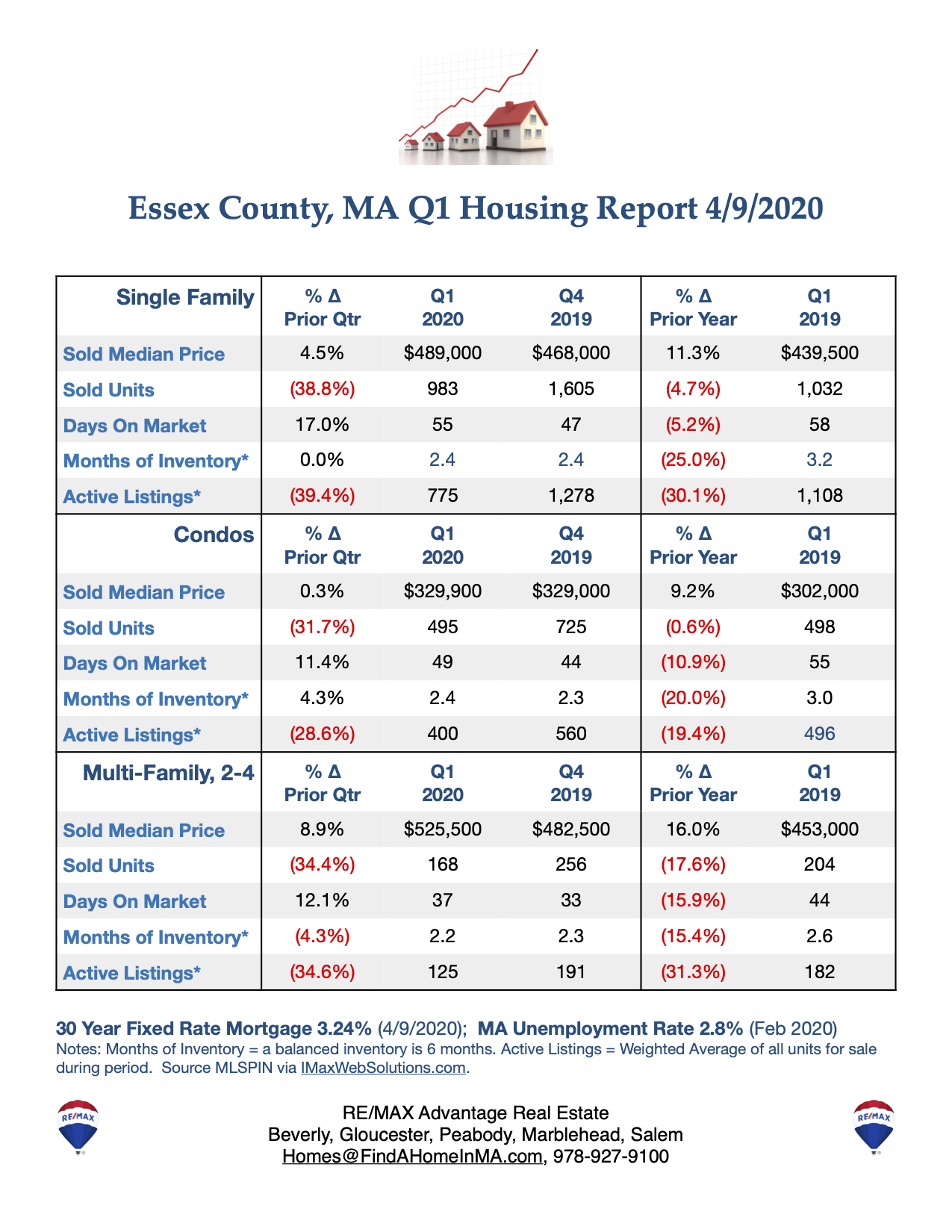

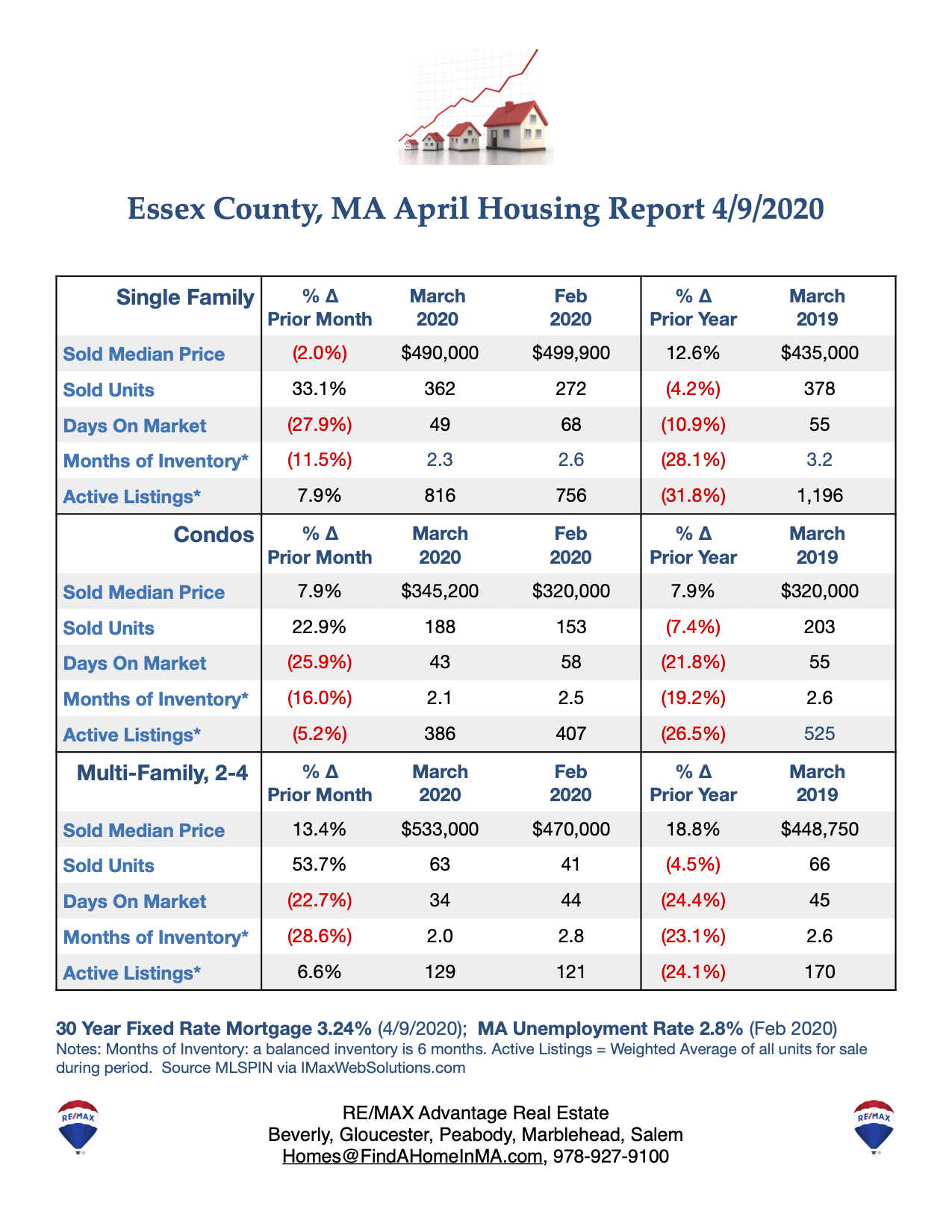

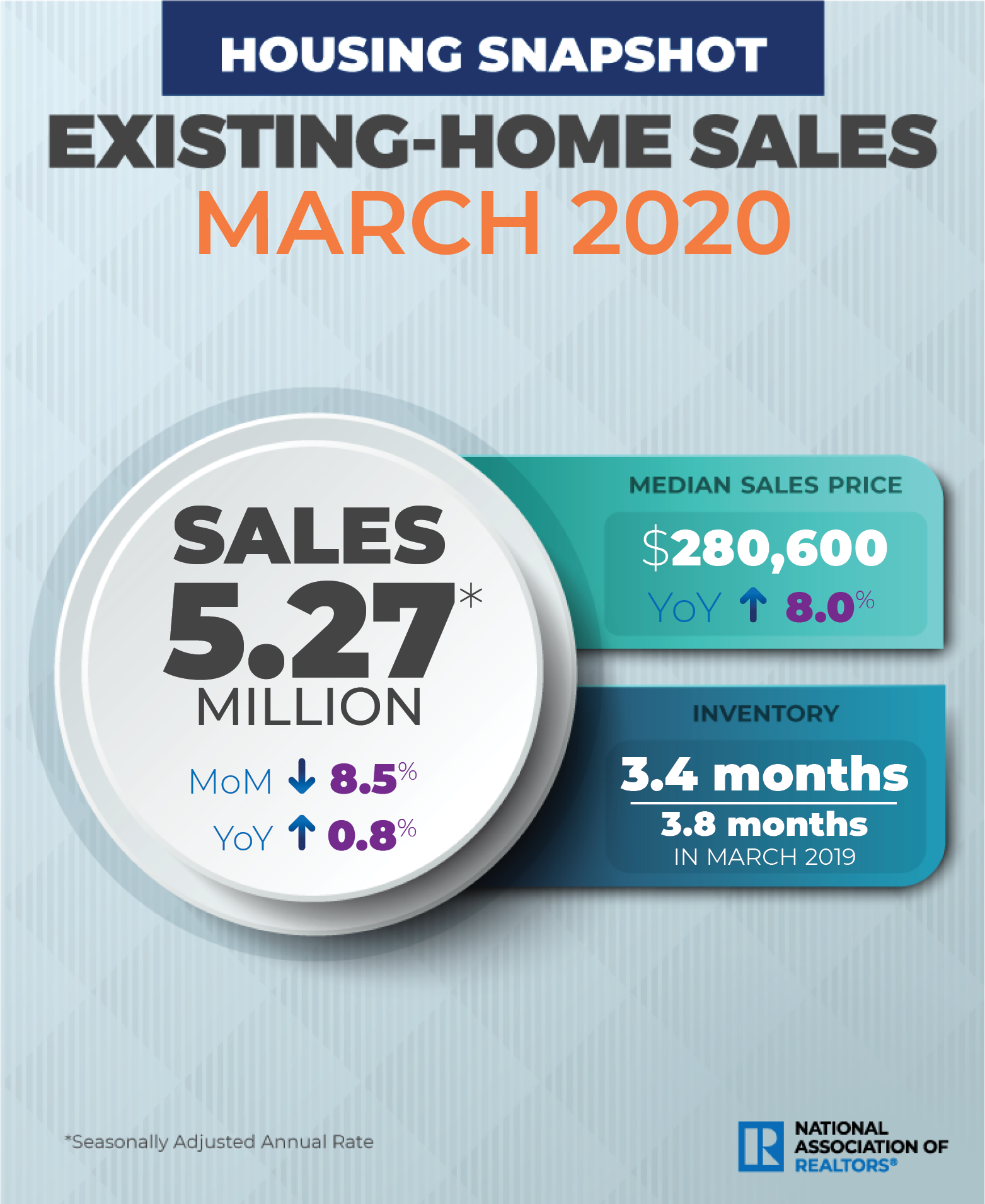

While existing-home sales dipped in March as the COVID-19 pandemic sparked stay-at-home restrictions across the country, they're not far off from the numbers a year ago, and home prices continue to rise.

The National Association of REALTORS®’ monthly existing-home sales—which includes completed transactions for single-family homes, townhomes, condos, and co-ops—dropped 8.5% in March compared to February. Sales were at a seasonally adjusted annual rate of 5.27 million in March—down just 0.8% from a year ago.

All four major regions of the U.S. reported a dip in sales last month. The West saw the largest drop, down 13.6% in March compared to February.

“Unfortunately, we knew home sales would wane in March due to the coronavirus outbreak,” says Lawrence Yun, NAR’s chief economist. “More temporary interruptions to home sales should be expected in the next couple of months, though home prices will still likely rise.”

Home prices remain strong, even early in the pandemic. The median existing-home price for all housing types in March was $280,600, up 8% from a year ago. Also, home prices rose in every region of the U.S. last month.

REALTORS® are still finding ways to get sales done amid social distancing and stay-at-home measures aimed at slowing the spread of the coronavirus.

“We have seen an increase in virtual home tours, e-signings, and other innovative and secure methods that comply with social distancing directives,” says Vince Malta, NAR president. “I am confident that REALTORS® and brokerages will adapt, evolve, and fight, ensuring the real estate industry will be at the forefront of our nation’s upcoming economic recovery.”

Here is a closer look at additional housing indicators from NAR’s report, reflecting March housing data:

Housing inventory: Total housing inventory at the end of March totaled 1.50 million units, up 2.7% from February but down 10.2% from a year ago. Unsold inventory is at a 3.4-month supply at the current sales pace.

“Earlier in the year, we watched inventory gradually tick upward, but with the current quarantine recommendations in place, fewer sellers are listing homes, which will limit buyer choices,” Yun says. “Significantly more listings are needed and more will come on to the market once the economy steadily reopens.”

Days on the market: Properties stayed on the market an average of 29 days in March, down from 36 days in February and down from 36 days in March 2019. Fifty-two percent of homes sold in March were on the market for less than a month.

First-time buyers: First-time buyers comprised 34% of sales in March, up from 32% in February and from 33% a year ago. “Despite the social distancing restrictions, with many REALTORS® conducting virtual open home tours with mortgage rates on the decline, a number of first-time buyers were still able to purchase housing last month,” Yun says.

Investors: Individual investors or second-home buyers purchased 13% of homes in March, down from 17% in February and down from 18% a year ago. Investors tend to account for the biggest bulk of all-cash sales. All-cash sales comprised 19% of transactions in March, down from 21% a year ago.

Distressed sales: Foreclosures and short sales comprised 3% of sales in March, unchanged from a year ago.

Regional Breakdown

Here’s how existing-home sales fared across the country in March.

Midwest: Existing-home sales decreased 3.1% in March, reaching an annual rate of 1.25 million. Sales were down 4.2% from a year ago. Median price: $219,700, up 9.7% from a year ago.

Northeast: Existing-home sales dropped 7.1% in March. Sales were at an annual rate of 650,000, a 3% decrease from a year ago. Median price: $300,400, up 8.3% from March 2019.

South: Existing-home sales fell 9.1% to an annual rate of 2.29 million in March, up 0.9% from a year ago. Median price: $245,100, up 7.5% from a year ago.

West: Existing-home sales dropped 13.6% to an annual rate of 1.08 million in March, a 0.9% decline from a year ago. Median price: $420,600, up 8% from March 2019.